- Home

- »

- IT Services & Applications

- »

-

Global PropTech Market Size, Share & Growth Report, 2030GVR Report cover

![PropTech Market Size, Share & Trends Report]()

PropTech Market (2022 - 2030) Size, Share & Trends Analysis Report By Property Type (Commercial, Residential), By Solution (Software, Services), By Deployment (Cloud, On-premise), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-019-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

PropTech Market Summary

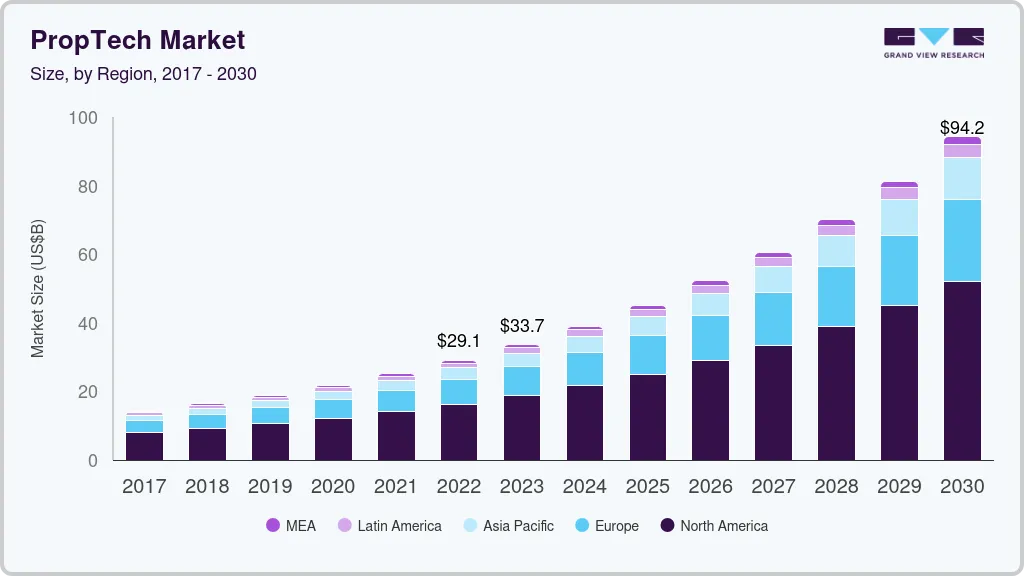

The global PropTech market size was estimated at USD 25,145.1 million in 2021 and is anticipated to reach USD 94,200.07 million by 2030, growing at a CAGR of 15.8% from 2022 to 2030. The growth is anticipated to be driven by the increasing adoption of several cutting-edge technologies, such as the Internet of Things (IoT), machine learning (ML), artificial intelligence (AI), and virtual reality (VR), across the real estate industry.

Key Market Trends & Insights

- North America accounted for the largest revenue share of 55.8% in 2021.

- The Asia Pacific region is anticipated to emerge as the fastest-growing region, registering a CAGR of 17.3% from 2022 to 2030.

- By property type, the residential segment accounted for the highest market share of 57.2% in 2021.

- By solution, the software segment accounted for the highest revenue share of 63.0% in 2021.

- By deployment, the on-premise segment accounted for the largest revenue share of 50.4% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 25,145.1 Million

- 2030 Projected Market Size: USD 94,200.07 Million

- CAGR (2022-2030): 15.8%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Additionally, adopting such technologies helps streamline data management and simplifies massive property management operations. Furthermore, AI helps in understanding and recommending client preferences. Artificial intelligence in the real estate sector can help fine-tune advertising efforts by spotting trends and delivering actionable insights to clients and customers. The growth is expected to be driven by the increasing demand for property management software (PMS) and asset management software. Using the software provides efficiency in transactional costs and the development of consumer convenience, with the customer always being the priority. Furthermore, such software offers easy maintenance monitoring, smoother payments among tenants and contractors, data tracking, and quick inspection. A PMS shortens the time it takes to reply to tenant or owner concerns and grievances.

The property technology (PropTech) market is expected to be driven by the increasing adoption of big data analytics owing to the benefits offered, such as helping in increasing overall productivity, making better decisions, improving customer service, and increasing overall revenue. Property investors are profiting from the insights provided by big data solutions, ranging from understanding the best investments to marketing and selling. Additionally, most companies are inclined to use big data techniques to differentiate themselves and stay competitive in the business.

For instance, Zillow Rental Manager is one of the "big data" programs that sets the real estate industry's trends. By employing big data, agents can provide customers with the property details in which they have shown interest. Additionally, financial risks are decreased when big data is used in commercial real estate. It examines all available information about a property and its previous owners to assess its worth and suggest the necessary next steps.

Moreover, the adoption of cloud computing is one of the key developments in the real estate industry. Cloud computing has substantially altered how software programs are managed and delivered to end users. Such advancements have enabled software developers to focus on cloud-based software technology. Multifamily residential property management businesses may readily incorporate Software as a Service (SaaS) platforms to combine online payment solutions with their property management software for easier transactions.

In the wake of the COVID-19 pandemic, there has been a significant disturbance in most sectors across the globe. The pandemic led to a small decline in the market initially during the lockdown. However, the market is expected to recover post-pandemic. The pandemic propelled the adoption of digital technologies across the real estate industry, such as virtual and augmented reality, cloud computing among consumers for online searches, and offering customers a more exciting and accessible buying experience.

Due to the pandemic, technological advancements including digitalization, cloud usage, big data analytics, and artificial intelligence have all gained acceleration and set the way for future growth in the property technology industry. To meet current customer demand and expectations, proptech businesses are focusing on decreasing various complexities in the home-buying process such as challenges in budgeting and bank loans, hiring a verified real estate agent, and dealing with inspection and document issues, among others, by using the aforementioned tech developments.

Property Type Insights

The residential segment accounted for the highest market share of 57.2% in 2021 and is projected to continue its dominance over the forecast period. This dominance is attributed to technological advancements in the residential sector across the real estate industry. The residential sector has drawn more attention from tech companies as they provide services, including digital closings and virtual open houses. Technological developments have made the first steps easier to reach for prospective house buyers.

They can search for houses on various platforms, assess features and costs, and even take virtual tours. Thus, most tech start-ups are inclined towards offering customized housing solutions to fit consumer requirements, which in turn is boosting the residential segment’s growth. The residential segment is further categorized into multifamily apartments/housing, single-family housing, and others. The multifamily segment is expected to register considerable growth over the forecast period.

The commercial and industrial segment is anticipated to register the fastest CAGR over the forecast period. The growth of the segment is attributed to the increasing demand for office spaces and growing urbanization across the globe. The use of cutting-edge technology for property management in the commercial and industrial real estate sector has observed significant growth in the past few years.

In the commercial and industrial sectors, proptech is completely revamping office buildings. PropTech solutions that integrate with IoT and smart devices are changing workspaces into smart offices. Thus, PropTech has become an essential tool in the commercial and industrial sectors. Moreover, the commercial and industrial segment consists of various sub-segments, such as retail spaces, office spaces, hotels, warehouses, and others. Among these, the retail spaces accounted for the highest share of 30.10% in the market.

Solution Insights

The software segment accounted for the highest revenue share of 63.0% in 2021 and is projected to continue its dominance in the coming years. The segment's growth is attributed to the associated benefits of proptech software, such as how it assists real estate managers and agents in marketing properties more quickly, efficiently, and with greater quality results.

The software segment is further divided into property management, asset management, sales and advertisements, work order management, customer relationship management, and others. Property management dominated the market in 2021 and is expected to continue its dominance owing to the benefits offered, which include quick accessibility to information, cost efficiency, and improved communication, among others.

The services segment is expected to register the highest CAGR over the forecast period. The segment's growth is attributed to the increasing demand for property search tools, new renting practices, selling alternatives, and new concept agents & landlord services, among others.

The services segment is further divided into professional and managed services. The professional services segment dominated the market in 2021 and is expected to continue its dominance during the forecast period. The segment's growth is owing to the increasing demand for professional services across the real estate sector, such as consulting, advisory, and portfolio analysis.

Deployment Insights

The on-premise segment accounted for the largest revenue share of 50.4% in 2021. The growth is due to the associated benefits of on-premise deployments, such as control and ownership over hardware and a higher level of data security than cloud-based proptech software. In addition, on-premise deployment offers businesses or firms customization as per their requirements. The benefits mentioned for on-premises deployment contribute to the segment's growth during the forecast period.

The cloud-based segment is anticipated to register the fastest CAGR over the forecast period. The segment's growth is attributed to the growing adoption of cloud deployment across various end-users, including housing associations, property managers, property investors, and others. Additionally, features including simplicity of use, scalability, affordability, and reduction in tenant conflicts are motivating small, medium, and big businesses to switch to cloud-based proptech solutions.

In addition, cloud-based deployment provides businesses with a backup feature and seamless data integration, which assists in preventing data loss. Additionally, it saves property managers direct and indirect expenses by automating a labor-intensive process.

End-user Insights

The housing association segment accounted for the highest market share of 34.3% in 2021 and is expected to witness considerable growth over the forecast period. This growth is attributed to the hurdles faced by townships and apartments, such as receiving payments, performing maintenance, and tracking tenants. All such challenges have forced key players in the market to provide solutions for payment tracking, inspections, and transparent and comprehensive reporting. Affordable housing using proptech software assists in assigning correct rent payments based on the amount contributed by the rent payer over government payment.

The property managers/agents segment is anticipated to register the fastest CAGR during the forecast period. This expansion of the segment is driven by the rising number of commercial buildings and real estate developments across the globe. PropTech adoption by property managers has the potential to significantly impact and improve their business models. For instance, agents can improve the availability of their property information by using machine learning and AI tools offered by PropTech.

Tenants can find it simpler to get the answers they need if the search engine has a chatbot AI that can respond to client questions and requests without any human intervention. Furthermore, proptech software helps property managers and agents maintain track of all properties, including essential maintenance work, automation, better communication, and easier accessibility.

Regional Insights

North America accounted for the largest revenue share of 55.8% in 2021. The regional growth is attributed to the presence of prominent players in the region, such as Ascendix Technologies, Zumper Inc., Opendoor, and Altus Group, among others. The real estate sector in North America is growing, being one of the most stable and promising industries. The region is considered to be an early adopter of technologies. The millennial generation in the region, which is well-versed in technology, accounts for around 43% of the housing market, which is driving up demand for smart homes with IoT-enabled gadgets. This, in turn, is boosting the market growth in North America.

The Asia Pacific region is anticipated to emerge as the fastest-growing region, registering a CAGR of 17.3% from 2022 to 2030. The regional growth is attributed to the increasing investment in proptech across the APAC region. According to the industry expert analysis, the largest proptech markets in the APAC are found in China and India, with total proptech investment amounts of USD 12.5 Bn and 9.1 Bn, respectively, in 2022.

Proptech companies in the region are focusing on expanding, becoming more mature, and demanding larger funding. Furthermore, technological innovations such as data analytics, Artificial Intelligence (AI), machine learning (ML), and voice commands to improve the capability of proptech software are expected to increase the adoption of proptech software in the region.

Key Companies & Market Share Insights

The proptech industry is considered to be a highly competitive market with a number of notable market participants. As part of their attempts to improve their offerings, market leaders are pursuing various initiatives, including strategic alliances, the launch of new products and services, and regional growth, among others.

For instance, in July 2019, ManageCasa, which recently launched interactive and automated PropTech for property owners and property managers, announced a partnership with Stripe, the online payment-processing platform, to develop a new digital payments solution for the property management sector.

Additionally, in August 2022, the US portal Zumper received $30 million to create a short-term rental product, making it the first real estate marketplace to provide alternatives for annual, monthly, and nightly rents. Some prominent players in the global proptech market include:

-

Ascendix Technologies

-

Zumper Inc.

-

Opendoor

-

Altus Group

-

Guesty Inc.

-

HoloBuilder, Inc.

-

Zillow, Inc.

-

ManageCasa

-

Coadjute

-

Vergesense

-

Reggora

-

Enertiv

-

Homelight

-

Proptech group

-

Qualia

PropTech Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 29,090.3 million

Revenue forecast in 2030

USD 94,200.7 million

Growth rate

CAGR of 15.8 % from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Property type, solution, deployment, end-user, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Brazil

Key companies profiled

Ascendix Technologies; Zumper Inc.; Opendoor; Altus Group; Guesty Inc.; HoloBuilder, Inc. ; Zillow, Inc.; ManageCasa; Coadjute; Vergesense; Reggora ; Enertiv ; Homelight; Proptech group; Qualia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PropTech Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global proptech market report based on property type, solution, deployment, end-user, and region:

-

Property Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Residential

-

Multi-Family Housing

-

Single Family Housing

-

Others

-

-

Commercial And Industrial

-

Retail Spaces

-

Office Spaces

-

Hotels

-

Warehouses

-

Others

-

-

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Property Management

-

Rental Listings Management

-

Applicant Management

-

Reporting & Analytics

-

Maintenance Activities Management

-

Others

-

-

Asset Management

-

On/Offline Rent Payments

-

Portfolio Management

-

Evaluation and Financial Management

-

Others

-

-

Sales and Advertisements

-

Work order Management

-

Customer Relationship Management

-

Customer Service

-

Customer Experience Management

-

CRM Analytics

-

Marketing Automation

-

Social Media Monitoring

-

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud-based

-

On-premises

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Housing Associations

-

Property Managers/ Agents

-

Property Investors

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global PropTech market size was estimated at USD 25,145.1 million in 2021 and is expected to reach USD 29,090.3 million in 2022.

b. The global PropTech market is expected to grow at a compound annual growth rate of 15.8% from 2022 to 2030 to reach USD 94,200.7 million by 2030.

b. The Asia Pacific region is anticipated to emerge as the fastest-growing region, registering a CAGR of 17.3% from 2022 to 2030. The regional growth is attributed to the increasing investment in the proptech across the APAC region. Proptech companies in the region are focusing on expanding, becoming more mature, and demanding larger funding. Furthermore, technological innovations such as data analytics, Artificial Intelligence (AI), machine learning (ML), and voice commands to improve the capability of proptech software are expected to increase the adoption of proptech software in the region.

b. Some prominent players in the proptech market include Ascendix Technologies, Zumper Inc., Opendoor, Altus Group, Guesty Inc., HoloBuilder, Inc., Zillow, Inc., ManageCasa, Reggora, Qualia, Vergesense, and Coadjute among others.

b. The market is anticipated to be driven by the increasing adoption of several cutting-edge technologies, such as the Internet of Things (IOT), machine learning (ML), artificial intelligence (AI), and virtual reality (VR), across the real estate industry. Additionally, adopting such technologies helps streamline data management and simplifies massive property management operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.